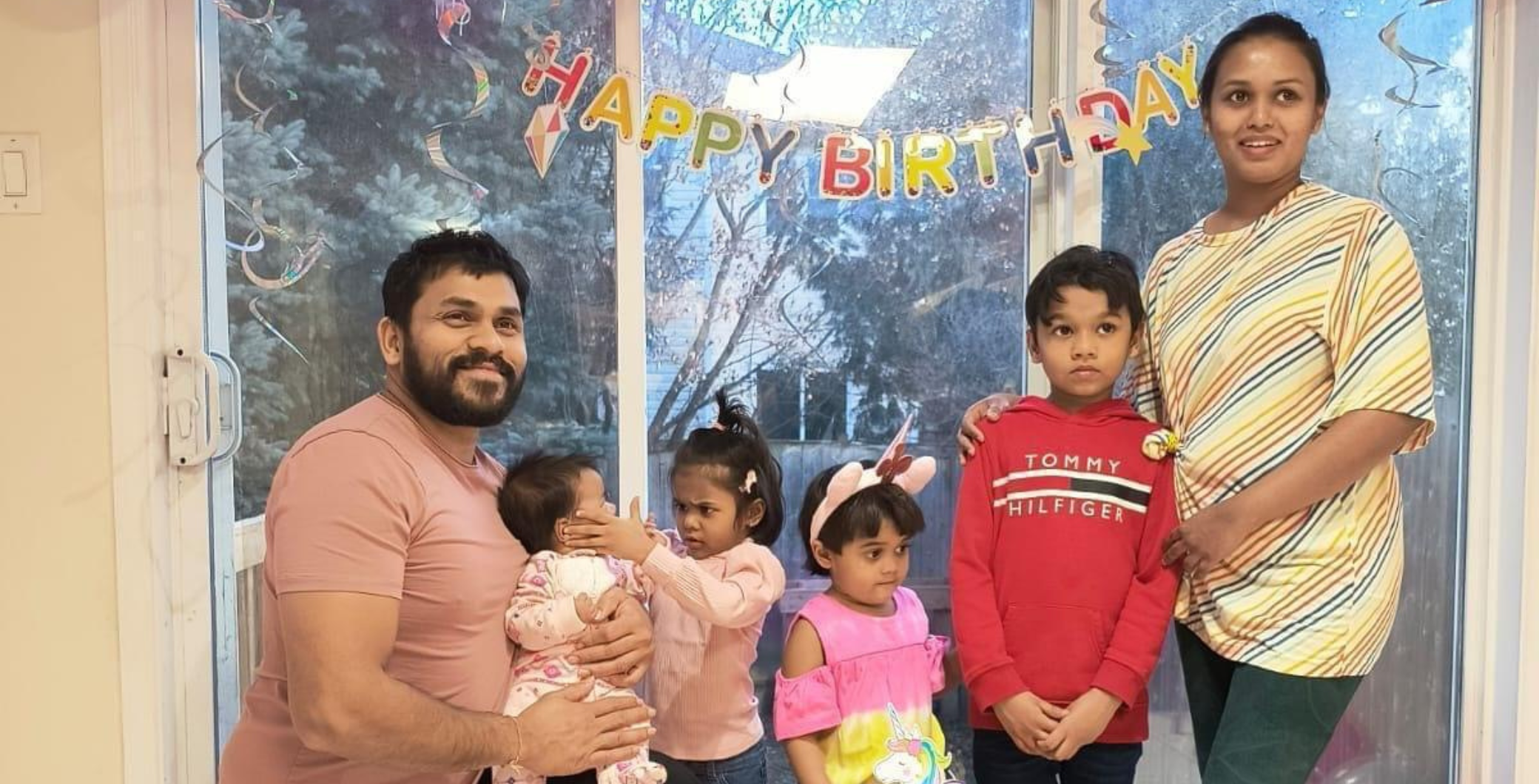

Data shows that housing affordability is improving in Canada, Courtesy: Canva

Even if you make a lot of money in Toronto, new data shows that it’s going to take a while to save up enough to buy a house.

According to the Housing affordability: Starting 2023 on a positive note report from the National Bank of Canada, it would take someone with a household salary of $236,221 approximately 25 years to save a down payment to purchase a house. That’s based on an average non-condo home price of $1,163,670 in Toronto with a savings rate of ten per cent.

Meantime, those looking to buy a condo in Toronto will also have years of savings ahead of them. With a median condo price of $695,691, someone with a household salary of $165,220 would have to save for 58 months before they have enough for a down payment.

Taking a look elsewhere, the report shows that people in Vancouver will also have to do some extensive saving. With an average non-condo home price of $1,587,439, those with a salary of $322,245 would have to save ten per cent of that income for 37 years to buy a home.

In Calgary, where the average cost of a home is $612,630, a potential homebuyer with an income of $146,251 would have to save for four years to make the required down payment.

Meantime in Montreal, an average home goes for $542,354, meaning that someone with a salary of $130,202 would have to save for 45 months.

However, things are improving. In the first quarter of 2023, Canadian housing affordability saw the largest improvement seen in 15 quarters.

The report also shows that throughout the quarter, housing affordability improved across all ten markets. This was the first time in 10 quarters that all markets improved. The data also shows that for the third quarter in a row, home prices were down.

Researchers say that after reaching its most unaffordable level in over 30 years, the mortgage payment as a percentage of income (MPPI) registered at 60.9% in Q1, which is still elevated, but down 5.4 points from the recent high mark.